?Udangbet77 is an online gambling platform that offers a variety of betting services, including slot games, sports betting, live casino games, and poker. Marketed primarily to an Indonesian audience, the platform positions itself as a trusted and premier destination for online gaming enthusiasts.?udangbet. Game Offerings The platform boasts a

https://instaviewer.app/instaspy-review/

InstaViewer enhances your Instagram experience by allowing seamless profile exploration with ease. It offers quick access to photos, videos, and updates while ensuring a user-friendly interface. Perfect for staying informed and inspired, InstaViewer helps you connect, discover trends, and enjoy content effortlessly while respecting privacy and

How to Interpret SafeCard Reviews and Decide If It’s Right for You

Choosing the right financial product, especially one that involves security and identity protection like SafeCard, requires careful research. Reviews from other users provide valuable insights into the advantages and potential drawbacks of a product, helping you determine whether it aligns with your needs. However, not all reviews are equally r

Discover the Future of Digital Interaction with Holofex: A Comprehensive Overview

Revolutionizing Aesthetic Displays with Holofex's 3D Holographic Technology In today's fast-paced digital world, catching attention is tougher than ever. Old-fashioned features usually crash to activate audiences, leading to overlooked opportunities. Nevertheless, Holofex is transforming that landscape having its cutting-edge 3D holographic tech

A Deep Dive into Holofex: Features and Advantages for Users

Revolutionizing Visible Exhibits with Holofex's 3D Holographic Technology In today's fast-paced digital earth, catching interest is more challenging than ever. Conventional displays often fail to interact audiences, resulting in overlooked opportunities. Nevertheless, Holofex is transforming that landscape using its cutting-edge 3D holographic t

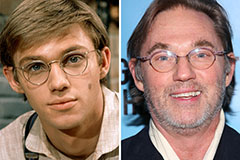

Bug Hall Then & Now!

Bug Hall Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Richard Thomas Then & Now!

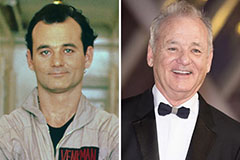

Richard Thomas Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!